Adam Leitman Bailey Due Diligence Report 6

DUE DILIGENCE REPORT

Prepared By

Adam Leitman Bailey, P.C.

120 Broadway, Seventeenth Floor

New York, New York 10271

(212) 825 – 0365

alblawfirm.com

May 7th, 2014

Introduction

This report includes our due diligence research findings and analysis of the rent regulatory status of the residential units of Street, New York, N.Y. (Manhattan Block Lot and an analysis of whether the free market apartments are properly deregulated.

The firm’s research also includes a review of the status of any open violations issued against the building by the Department of Housing Preservation and Development of the City of New York and the New York City Department of Buildings.

The firm also searched the files of the Supreme Court of the state of New York, New York County, the civil court of the City of New York and the Housing Court of the City of New York for pending litigation as well as litigation related to the 1995 fire which vacated the entire building and purportedly yielded deregulation of all the units. The firm’s court investigations also included a review of any judgments and liens held against the property.

The firm’s investigations produced the following results.

Overview of the Building

The building consists of 24 Class A residential units spread over six stories. On December 12, 2000, the Department of Buildings issued a Certificate of Occupancy following the fire restoration work performed at the building. We presume that the Department of Buildings required the owner to apply for a Certificate of Occupancy before tenants could re-occupy the building and in light of the fire restoration work and since the building had been vacant for five years. The actual use of the residential units appears to be consistent with the Certificate of Occupancy for the building. A copy of the Certificate of Occupancy is provided together with this report.

Unconfirmed Deregulation of the Units

The Building’s Ownership and Rent Registration History

The firm’s research indicates that the fire took place on April 7, 1995. In May 1995, the then rent-stabilized tenants filed applications for rent reductions at the Division of Housing and Community Renewal. At the time of the fire the building was owned by an entity called “Order [redacted] A deed recorded on December 22, 1997, conveys the building from the “Community Service Society of New York Dev.” To one “ [redacted] who apparently sold the building to the current owner, [redacted] on September 23, 1999. The Department of Finance recordings do not indicate how the Community Service Society came to own the building in 1997, which is two years after the fire, but the firm presumes that that entity came in for the purpose of reactivating a building that had lain fire damaged and vacant for two years. After [redacted] purchased the building in December 1997, he immediately began the fire restoration project but sold it to the current owner before the Certificate of Occupancy was issued for the property. The firm recommend that the current owner provide his previous title report to see just how that break in the chain of title is explained. That report may also shed light on the liens the firm discovered in court investigations and report on below.

The dearth in informative rent registrations since the 1995 fire gave rise to this review of the history of ownership. If you choose to purchase the building, the firm suspects it will be an uphill battle, to say the least, to obtain the documents and information necessary to properly paper the deregulation of these units. Not one of the twenty four units has been properly deregulated according to the public records, namely the Division of Housing and Community Renewal Rent Registration Report and the firm’s court investigation findings. Further, our research indicates that it is most unlikely that the units can be deregulated, except with very heavy further investment in the building and a somewhat cooperative tenant population.

The units are last registered in 2001 as permanently exempt after three years of having been registered as rent stabilized with a legal -regulated rent of $1. The $1 legal regulated rent resulted from the rent reduction applications that were filed by all but two of the tenants ( [redacted] Apartment 1C may have surrendered her tenancy post-fire based on the unit having been registered as “vacant” in 1995. The firm can make no assumptions regarding what happened to the tenant in [redacted] post-fire. The firm suspects he may have abandoned his tenancy but never notified the then owner. He appears on the 1995 registration with a $1 legal-regulated rent, even though an application for a rent reduction was never filed.

After the fire restoration work was completed in 2000, [redacted] registered each of the units as vacant with the corresponding pre-fire legal regulated rent. The following year, [redacted] registered each unit, changing the apartment denominations building wide from 1A, 1B, 1C, 1D to 1, 2, 3, 4 and identifying them as permanently exempt. There is no indication as to by what means these units deregulated. If the owner claims that the units deregulated by high rent vacancy deregulation, then you should request documents to support individual apartment improvements 1/40th of the cost of which can be applied to the legal regulated rents together with the applicable vacancy increase. The firm can run those calculations for you, if you wish. However, prior to incurring those expenses, the firm recommend you ask the owner if these documents even exist. Proof of renovations include, but are not limited to, contractor invoices marked “paid,” receipts for supplies and cancelled checks. Notably, applying the vacancy increase to the last legal-regulated rent for each unit does not increase the rent to the $2,000 high rent vacancy threshold that was required at the time.

In addition, if the owner is able to produce proof of renovations to justify high rent vacancy deregulation of the units, the firm recommends you inquire whether any insurance funds were used towards the fire restoration. Individual apartment improvement rent increases are not permitted if insurance funds were used to pay for the renovations. Given the fact that the owner who commenced the fire restoration work was not the owner at the time of the fire, we would be surprised if an insurance company covered the claim.

During the firm’s conference call on May 6, 2014, it discussed various means of properly deregulating the apartments and protecting yourself from overcharge liability post-closing should you choose to purchase the building. The firm covers those again below.

Substantial Rehabilitation

An apartment qualifies for deregulation if, while it is vacant, the owner substantially alters its outer dimensions, creating a “new” apartment. Therefore, once you purchase the building and each unit is vacated, perform construction such that none of the exterior walls of the old apartment are where they were originally. At least one wall must be other than where it used to be in order for the units to deregulate by substantial rehabilitation.

Renovations to Ensure the Legal Regulated Rent Exceeds $2,500

Once each unit is vacated, perform enough renovations in each apartment so that 1/40th of the cost of the construction plus the legal-regulated rent reported on the 1995 DHCR Registration Rent Roll Report (page 14 of the report) raises the legal-regulated rent to above $2,500. You may also apply a vacancy increase to the 1995 legal regulated rent to help get to the $2,500 threshold. In 1995, 5% was the allowable vacancy rents for legal rents less than $1,000, which was the case for all apartments in this building at that time.

You are required to maintain at least one of the following documentary proofs of renovation to support deregulation of the units:

- Cancelled check(s) contemporaneous with the completion of the work;

- Invoice receipt marked paid in full contemporaneous with the completion of the work;

- Signed contract agreement;

- Contractor’s affidavit indicating that the installation was completed and paid in full.

Require the Building Be Delivered Vacant at Closing or Calculate the Cost of Vacating the Apartments

You may consider requiring the building be delivered vacant at closing so that you do not also incur the cost of litigation to evict those tenants, if any, that do not move out of their apartments so easily. If such a provision cannot be negotiated, you should calculate the potential cost of that litigation by investigating through the seller, perhaps, which tenants are willing to move out upon thirty day notice. That cost should be considered now as you decide whether to pursue the purchase. According to the seller’s disclosures, all tenancies are currently month to month. Therefore, the tenants should vacate upon thirty day notice assuming they do not research the rent-stabilization history of their apartments. However, you know too well that even valid market, month to month tenancies may require commencing an eviction proceeding in housing court to get the vacancy. If such actions are started, it would not be surprising that the tenants lawyer up and the lawyer in question could discover the same discrepancies the firm did.

Notably, Apartment 25 is purportedly occupied by a superintendent. You should ask the seller how long the superintendent has lived in that apartment and if he/she has lived there for more than four years, obtain an affidavit from the superintendent stating so and register the apartment with DHCR to reflect that the unit has been owner/employee occupied for the past four years and that as of 2014, the unit is permanently exempt from regulation. If the superintendent has not lived in the apartment for more than four years, then the firm recommends you obtain a vacancy and properly deregulate the unit by one of the methods set forth in this report.

Require Funds be Escrowed to Cover Potential Overcharge Liability

As the firm has discussed, many of the tenants who were forced to flee the building after the building sought to ensure that their regulated tenancies were protected and that they would be reinstated to possession of their apartments after the owner repaired the building. The tenants of all units, except 1C and 5A, successfully filed applications with the DHCR immediately after the fire requesting that their rent be reduced to $1 until they move back in to their apartments, essentially. That $1 payment each month indicates the tenant’s continuing intention to return to the apartment after construction.

Indeed, almost twenty years has elapsed since the fire forced the tenants out of their apartments. Obviously, there is a strong likelihood that many of the tenants are not likely to return to the building or moreover, are not easily found today. However, if the $1 per month tenants paid the $1 each and every month since the issuance of the DHCR orders, then they were entitled to return to their apartments after the building was restored and a Certificate of Occupancy was issued. If a tenant failed to pay the $1, the tenant would not have been entitled to return to the building, but any subsequent tenants would be rent stabilized because none of the work performed to rebuild the building (i.e. repairs) can go toward “individual apartment improvements” or “substantial rehabilitation” for the purpose of deregulation.

Setting aside the unlikelihood that a $1 tenant would return today, there is significant overcharge liability should any current or recent tenant investigate an apartment and learn this history. Overcharge liability amounts to the difference between what the tenant paid in rent in the past two years and the 1995 legal regulated rent, trebled. The more onerous downside may be that that unit (and tenancy) is now rent stabilized until properly deregulated by valid means.

You may consider requiring the seller to escrow enough funds to cover that exposure to overcharge liability plus legal fees that you will incur in the event an overcharge proceeding is commenced against you as the new owner. Once you have completed “substantial rehabilitation” or sufficient individual apartment improvements to raise the legal-regulated rent to above $2,500 then the escrowed funds can be released to the seller minus any expenses that you may have incurred to defend any overcharge case.

New York City Violations Issued Against the Building

NYC Department of Buildings (DOB)

The Department of Buildings classifies this building as “D9-Elevator Apartment.” This is a Department of Finance classification used to classify the premises’ tax status, as distinct from its legal use which is typically set forth in the Certificate of Occupancy. As noted above, there is a valid Certificate of Occupancy for this building on file with the DOB. A walk-thru and inspection of the building is necessary to verify the use of the building and confirm exactly how many residential and commercial units there are in the building.

There are two open, elevator DOB violations issued on October 1, 1995 and September 19, 2013. You can view the building’s property profile and open violations online using the New York City Department of Buildings’ Buildings Information System located at http://a810-bisweb.nyc.gov/bisweb/bsqpm01.jsp. You can easily access that site by conducting a Google search on “Building Information System.” You should require the seller correct, or if already corrected, certify and pay any imposed fines prior to closing or alternatively, ensure you receive a credit for the cost of correcting violations that are open on the date of closing.

If you purchase the building, your pre-closing walk thru should include verification that all of the violations have been corrected and/or credited at the closing table.

Department of Housing Preservation and Development of the

City of New York (“HPD”)

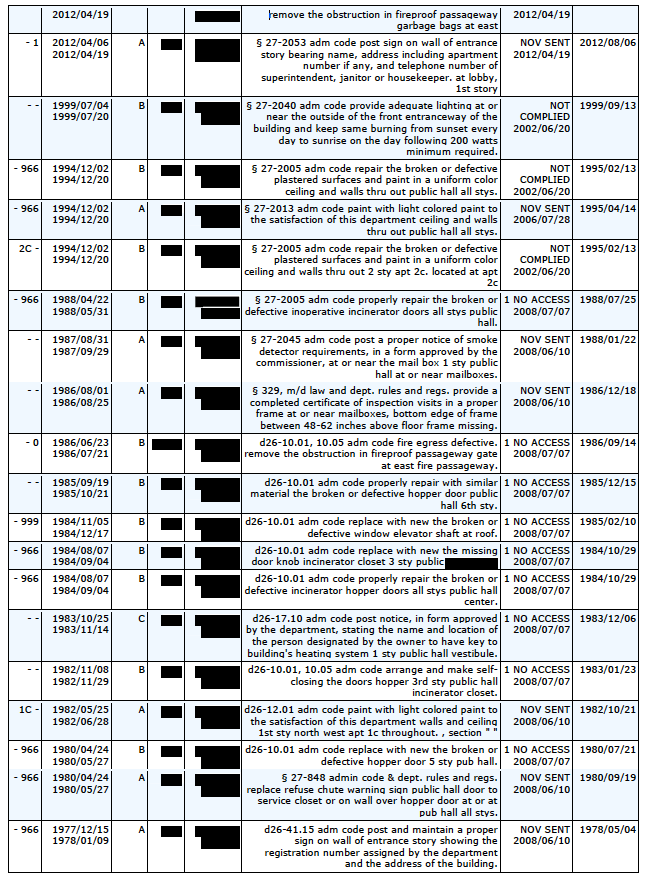

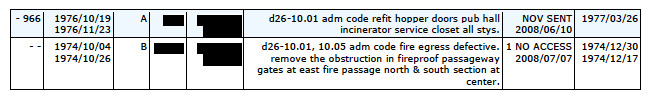

The firm provides below the building HPD Registration Summary Report and Open Violations. There are 25 open violations, 9 Class A, 15 Class B and 1 Class C violations. Five of the violations were issued in 2012 and involve common areas of the building which is a good sign that the current tenants are not “difficult tenants” in that they call 311 with every complaint, big or small. The remainder of the violations were issued in the 70s, 80s and 90s. This relatively low violation count indicates that the building has been well managed and maintained, at least in recent years, and unlikely to contain many latent defects, if any.

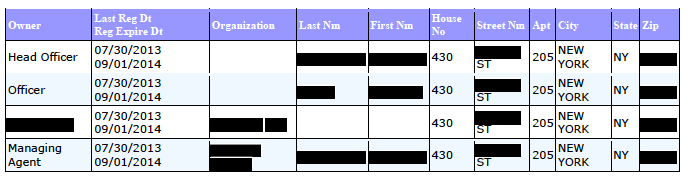

Building Registration Summary Report

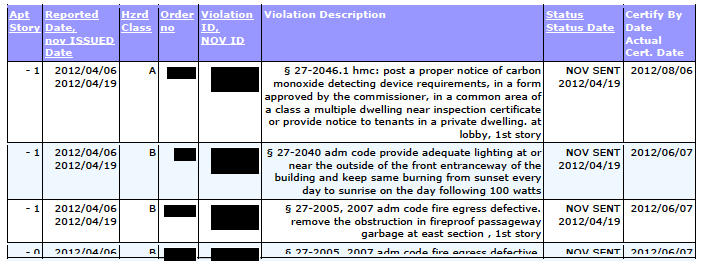

Open Violations – ALL DATES

There are 25 Violations. Arranged by category: A class: 9 B class: 15 C class: 1 I class: 0

The firm suggests you negotiate a credit for each of the open HPD violations or have them resolved by the closing date and demand proof of payment for all associated administrative fees, if any. When you conduct the pre-closing walk-thru of the building, you should confirm that each violation has been corrected and photograph each repair.

Property Shark Report

The Property Shark Report for the building, which includes information pertaining to the neighborhood, ownership, property tax assessment, zoning and size, is provided with this report.

Court Investigations

Housing and Civil Court Cases

The firm conducted court investigations by searching for litigation involving the current owner, [redacted] and the prior ownership entities, Order [redacted] and Community Service Society of New York Development.

Housing Court

[redacted] brought two summary proceedings during its ownership thus far. One case is a 2006 holdover proceeding against a tenant that no longer resides in the building. That case was discontinued after two court appearances which is a strong indication that the tenant moved out shortly after the case was commenced. The other [redacted] case is a holdover proceeding against the former tenants of Apartment 6. That case culminated in the issuance of a warrant of eviction on June 7, 2013. Notably, Apartment 6 is one of the three currently vacant units.

There is one repair case against [redacted] by a current tenant, that is, [redacted] of Apartment 4, commenced in 2012. [redacted] has been a tenant in the building since April 2006 which for a “market” tenant is a relatively lengthy tenancy. Notably, there are no HPD violations associated with the apartment during the [redacted] tenancy which indicates that the violations related to this lawsuit were corrected. This history raises a flag for you as a potential owner who will seek to vacate all the units in the building. [redacted] is not likely to vacate easily. Therefore, you should anticipate and calculate the “cost and risk,” as explained earlier in the report, of having to evict him if you purchase the building.

One noted litigious tenant out of twenty four purportedly “market” units is not a bad statistic for measuring how easy it will be to vacate the building.

There are no housing court cases involving the prior owners, [redacted] or Community Service Society of New York Development. Order [redacted] brought four summary proceedings when they owned the building, that is, three nonpayment proceedings and one holdover proceeding involving a tenant that was not living at the building at the time of the fire. Together with this report, the firm provides a copy of the court’s computer detail on these proceedings and do not see anything worth noting for due diligence purposes.

There is no housing court litigation resulting from the April 1995 fire except for the Supreme Court case commenced by [redacted] (Apartment 4C) discussed below.

Civil Court

There was no litigation in civil court involving [redacted]. The firm will report on civil court litigation involving the prior ownership entities under separate cover because the computers at the civil court were out of service when the firm tried to search them on May 6, 2014.

Supreme Court

In 1998, [redacted] the tenant of the apartment formerly known as Apartment 4C, sued [redacted] Order [redacted] prior management and the then mortgage note holders in negligence, breach of contract, constructive eviction, breach of the warranty of habitability and for a declaration of his rights as a rent-stabilized tenant and that he is entitled to be restored to possession of the apartment. [redacted] and [redacted] entered into a stipulation discontinuing the action with prejudice on October 3, 2000. The firm is conducting further research to see whether a settlement agreement was filed or whether the settlement was conducted out of court. The firm recommends you ask the seller as to the details of the outcome of this case so that you can rest assured that there is one unit less that presents the potential for overcharge liability. A copy of the [redacted] summons and complaint and stipulation of discontinuance is provided with this report.

In 2002, one [redacted] sued [redacted] and [redacted] in negligence for an accident where fell [redacted] of a ladder while doing construction on the building in 1999. The case was discontinued on consent by a stipulation filed on November 17, 2004.

Judgments and Liens

The firm also ran judgment and lien searches by block and lot number. A detailed listing of each of the hits we obtained is provided with this report. Four of the liens are lis pendens docketed as follows: city of New York (5/22/1987), city of New York (9/24/1996), [redacted] (11/5/1992) and a [redacted] Street [redacted] (1/16/1997). One mechanic’s lien docketed in 1989 in the amount of $5,093.63 is held by [redacted]. There is also a sidewalk lien docketed on August 20, 2008, and held by the New York City Department of Transportation which is likely to be for sidewalk repair work that the city undertook since the owner did not do so.

The firm recommends you ensure that satisfactions of judgment are filed for each lien prior to closing, should you choose to purchase the building.

As you know, customarily prior to closing a title search is run on the property which provides a more complete and up- to-date picture of the liens held against the property.

Conclusion

As the firm has already indicated to you orally, it is highly unusual for the firm to deliver an oral due diligence report at all. While that conversation was not transcribed, the firm has endeavored to capture most of its salient points in this written report.

This is undeniably a relatively high-risk building. While the building may carry the potential for substantial profitability down the road (assuming a good purchase price), the short term risk of relatively massive expenses is vastly greater than in the typical transaction this office sees. Nearly every unit in the building is arguably rent stabilized.

Nearly every unit in the building is potentially the source of a punishing overcharge liability. If one tenant gets curious, that tenant could retain some of the more reputable tenant oriented firms in the building and the entire building could be, in short order, filled with rent-stabilized tenants with leases at rates that do not even pay the winter heating bills. Such tenants would be entitled to leases and perpetual tenancies. Under such a scenario, even if the building is structurally completely sound, it could turn into a classic money pit.