Adam Leitman Bailey Due Diligence Report 2

DUE DILIGENCE REPORT

PREPARED BY

ADAM LEITMAN BAILEY, P.C.

120 BROADWAY, SEVENTEENTH FLOOR

NEW YORK, NEW YORK 10271

(212) 825-0365

alblawfirm.com

January 23, 2013

INTRODUCTION

This due diligence report includes the firm’s research findings and analysis of the rent-regulatory status of each of the residential units in New York.

The firm’s due diligence investigation includes an analysis of how each free-market apartment was deregulated. As you know, [redacted] participates (or more accurately, was a participant) in the J-51 tax benefit program. Participation in the J-51 tax benefit program automatically creates stabilized tenancies building-wide and all tenancies remain stabilized until the expiration of the building’s tax benefits. Therefore, many of the “free market” units at [redacted] were analyzed from two perspectives, that is, stabilization in a traditional sense and stabilization stemming from participation in the J-51 program. This report advises you, as a prospective purchaser, of the owner’s risks and liability with respect to deregulation of the apartments.

The firm’s research also includes a review of the status of any open violations issued against the building by the Department of Housing Preservation and Development of the city of New York and the New York City Department of Buildings.

The firm also searched the files of the Supreme Court of the State of New York, New York County, the Civil Court of the City of New York and the Housing Court of the City of New York for pending litigation with respect to this building. The firm’s court investigations also included a review of any judgments held against the properties.

The firm’s investigations produced the following results.

[redacted] – The J-51 Building

The building at [redacted] consists of 25 residential units spread over five stories. The current, actual use of the residential units appears to be consistent with the Certificate of Occupancy for the building. A copy of the Certificate of Occupancy for the building is annexed hereto as Exhibit “1.”

As previously reported, [redacted] recently participated in the J-51 tax benefit program. Annexed hereto as Exhibit “2” is the J-51 Abatement and/or Exemption Data for the building.

When an owner takes advantage of J-51 tax exemption and abatement benefits, every tenancy that would otherwise be a free market tenancy becomes subject to rent stabilization. Notably, any units that were subject to rent stabilization before the tax benefits applied are not affected by the J-51 tax benefit participation.

Under the J-51 regulations and rent-stabilization law, each “free market” tenancy remains stabilized “forever” UNLESS the owner annexes and executes a “J-51 rider” with the tenant on each and every renewal and each and every new lease executed during the period of time that the benefits applies. That rider notifies the tenant of the unit’s stabilized status pending the expiration of the J-51 benefits and most importantly, notifies the tenant that the unit will no longer be protected by the rent-stabilization law once the tax benefit period expires. Annexed hereto as Exhibit “3” is a copy of a form J-51 Rider.

In the firm’s effort to confirm the building’s J-51 participation, the firm contacted the Department of Finance of the city of New York (“DOF”), initially, to confirm when the benefits were due to expire and to determine the dollar amount remaining on the tax abatement benefit conferred to the building through the J-51 program. That telephone conversation1 revealed that the building was a participant in the J-51 program over the past ten years but the benefits are now exhausted, as is also confirmed by the following J-51 Benefit History Summary which was copied from the DOF website:

J-51 Benefit History Summary

Tax Year 12/13

The firm then attempted to find out exactly when the benefits ran out by visiting the DOF at [redacted] but the agent there directed the firm to complete and submit an Exemption/Abatement Inquiry Form for the information. Unfortunately, the firm is told, these requests can take up to thirty days for the DOF to fulfill. The firm can submit a written request on your behalf, if you wish.

However, at this juncture, it makes best sense to request this information directly from the seller. As such, the firm recommends you demand the seller provide all documents related to the building’s J-51 participation, i.e. the Certificate of Eligibility, the J-51 application, and all documents enumerating the benefits received and the work performed. The seller should also disclose exactly when the abatement benefits ran out so that you can best ascertain the regulatory status of certain units. If a free market lease was executed after the J-51 benefits ran out, then it is safe from stabilization, assuming it is properly destabilized without reference to the building’s J-51 participation.

Absence of Renovation Documents

There are eight apartments at [redacted] that lack proof of renovation documents to support the deregulation of these units even before the building’s J-51 participation. When asked, management represented that the owner prior to the seller did not provide any renovation documents for these units. Each affected unit is identified in the enclosed Tenant File Review spreadsheet and each unit is individually treated with recommendations from the firm located in the last column of the spreadsheet.

Failure to Register the Building with DHCR in 2008, 2009 and 2010.

The 2008, 2009, and 2010 registrations were filed on June 1, 2011. Therefore, the exposure window for those units that deregulated by high rent vacancy in the years 2008, 2009, and 2010 but lack renovation documents did not begin until 2011 and will remain open to challenge at least until 2015.

Tenant File Review

On January 17, 2013, the seller’s managing agent provided current DHCR rent roll reports simultaneously with allowing six hours of access to their tenant files. From time to time, the agent would share “insider” information about tenants, pending litigation and pending buyout negotiations. The firm’s findings from its conversations with the agent and the review of the tenant’s files are provided in detail on the accompanying spreadsheets. Those spreadsheets also include detailed analysis of the deregulation of each unit as documented on the Division of Housing and Community Renewal (“DHCR”) Registration Rent Roll Reports.

Annexed hereto as Exhibits “4” (250)3 and “5” (234) are certified Division of Housing and Community Renewal Registration Rent Roll Reports for each of the buildings.

Out of the twenty-five residential units at [redacted] there are two rent-controlled apartments and twenty-three rent-stabilized apartments. As previously reported, the seller made a business judgment decision not to annex a J-51 rider to any renewal or new lease executed while the building participated in the J-51 program. The owner prior to the seller also had not annexed the rider to any of the renewals and leases executed during its tenure. According to the seller’s agent, the seller decided to “let a sleeping dog lie” since the tax benefit period is “due to expire this tax year.” The impact of this decision on you, as a prospective purchaser, is that every free market tenancy, though disclosed by the seller to be free market, is rent stabilized and remains rent stabilized even after the J-51 period expires. With the law of succession and such, this could make these units rent stabilized long after all of us are dead. Exceptions may lie only where “free market” leases were executed after the J-51 benefits were exhausted.

If you decide to pursue the purchase of this building, you should consider how you would like to seller to treat lease renewals of “J-51 stabilized but treated free market” tenancies that are executed during the contract period and through the day of closing. You may wish to negotiate a provision that no renewals be executed during the contract period but we understand that may give rise to a tenant investigating its tenancy rights. Those units that were stabilized before the J-51 benefits kicked in are, of course, entitled to lease renewals under the rent-stabilization law and could potentially [redacted] overcharge claims as well.

Intentionally Left Blank

The firm reviewed thirty tenant files for the building at [redacted]. However, the building is registered with HPD as having thirty-three residential units and Property Shark reports that that there are thirty-two residential units. A walkthrough of the building would confirm just exactly how many residential units are in the building. All sources are consistent in that the residential units are spread over six stories.

Use Inconsistent with Certificate of Occupancy

The actual use of the residential units appears to be inconsistent with the Certificate of Occupancy for the building. A copy of the Certificate of Occupancy for the building is annexed hereto as Exhibit “2.” According to the Certificate of Occupancy, the building consists of three stories with a store on the first level and two one family apartments on the second and third levels. You should investigate exactly how much it will cost you to legalize the building and obtain a certificate of occupancy consistent with its current use and makeup. Obviously, you want to negotiate favorable terms with the seller requiring the seller to legalize the building and obtain a proper Certificate of Occupancy or at the least, require the seller to incur the costs for professional services, fees, DOB filings etc. to do so.

The Mismanagement of 234 [redacted]

As previously advised, 234 [redacted] has been horribly mismanaged over the years and dating back several owners ago. The history of mismanagement at the building exposes future owners to liability for treble damages due to overcharging rent-stabilized tenancies, among the worst case scenarios, and to having to expend special resources to organize tenant files, obtain missing lease renewals and determine which of two lease renewals govern a tenancy today. In many cases, there are no fully executed leases or lease renewals which raises issues in litigation as a fully executed lease is necessary to prove standing to sue in housing court. There are mechanisms for getting around the absence of a fully executed lease but there is no guarantee that those mechanisms will be enough or will even be available to you on trial day.

The enclosed Tenant File Review spreadsheet treats each unit individually in terms of bringing to your attention the mismanagement issues present in each tenancy. The spreadsheet also provides our recommendations for legitimizing each tenancy’s documents.

For those units where there is overcharge exposure, the firm recommends you require the seller to refund any overcharges prior to closing or alternatively, you obtain a credit in the amount of any overcharges so that those tenants can be made whole as soon as you purchase the building.

DHCR CASE HISTORY

There is an open DHCR overcharge case brought by the tenant of Apartment 2 on March 11, 2011. Current management did not know that the case existed since it was commenced during the tenure of its predecessor owner. The firm advised management to submit a FOIL request to DHCR to obtain a copy of the entire file to ascertain whether an answer to the complaint was filed by the prior owner and what the status of the case is today. Interestingly, the tenant recently advised that he is vacating the apartment at the end of February. However, even if he vacates, the owner, or future owner, does not escape liability, if any, in the overcharge case. This unit is among the purportedly deregulated units that lack any renovation documents from the prior owner. As such, there is a substantial chance that his tenancy is rent stabilized, regardless of the building’s J-51 participation.

There are no other DHCR cases that should be of particular interest to you at this time.

As reported on the Tenant File Review spreadsheet for [redacted] there is a pending non-renewal of lease case at DHCR. This case was brought by Monica Ramirez, the occupant of Apartment 18, seeking confirmation of her rights to succession by way of her mother, Martha Rodriguez. The tenant file contained fully executed leases signed by the landlord and Monica Ramirez which is a good indication of her likelihood to succeed in this proceeding. The firm recommends you submit a FOIL request to DHCR to obtain a copy of the entire file to ascertain what defenses the seller has alleged and what is the status of the proceeding. A copy of the complaint is annexed hereto as Exhibit “11.”

There are no other DHCR cases that should be of particular interest to you at this time.

A copy of the DHCR case lists for each of the buildings are annexed hereto as Exhibits “16” (250) and “17” (234).

NYC Department of Buildings (DOB)

The Department of Buildings classifies each of the buildings as “C1-Walk-up Apartment.” This Department of Finance Building classification is used to classify the premises’ tax status, as distinct from its legal use which is typically set forth in the Certificate of Occupancy. As noted above, the current, actual use of the building appears to be consistent with the Certificate of Occupancy for the building. A walk-thru and inspection of the building is necessary to verify the use of the building and confirm exactly how many residential units there are.

There are no open DOB violations at [redacted].

The Department of Buildings tax classification for this building is “C7-Walk-up Apartment.” As noted above, the actual use of the building is inconsistent with the Certificate of Occupancy for the building. See Section “Use Inconsistent with Certificate of Occupancy” above.

As of January 23, 2013, there are six open Department of Building violations. Annexed hereto as Exhibit “19” are copies of the Open Violations. The open violations are from 2008 through 2010. There are three boiler violations, one work without a permit violation, a water leak and mold violation and a 2008 ceiling collapse violation. If you purchase the building, you should receive a credit for each open violation at closing, if they are not certified as corrected and dismissed before closing.

The DOB Property Profile Overview for each of the buildings is annexed hereto at Exhibits “18” (250) and “19” (234).

If you purchase the building, your pre-closing walk thru should include verification that all of the above violations [redacted] been corrected and/or credited at the closing table.

The Department of Housing Preservation and Development

of the City of New York (“HPD”)

There are four Class A violations, twenty-eight Class B violations and 9 Class C violations that the HPD considers open at [redacted] as of January 16, 2013. See Exhibit “13”.

There are nine Class A violations, fifty Class B violations and 5 Class C violations that the HPD considers open at [redacted] as of January 16, 2013. See Exhibit “14”.

You may want to get a credit for each of these open violations or [redacted] them resolved by the closing date and demand proof of payment for all associated administrative fees, if any. When you conduct the pre-closing walk-thru of the building, you should confirm that each violation has been corrected and photograph each repair.

Annexed hereto as Exhibits “20” (250) and “21” (234) are the HPD Building Registration Summary Reports and Open Violations for each of the buildings.

Property Shark Report

The firm [redacted] included a copy of the Property Shark Reports on each of the buildings which include information pertaining to the neighborhood, ownership, property tax assessment, zoning and size.

A copy of the reports are annexed hereto as Exhibits “20” (250) and “21” (234).

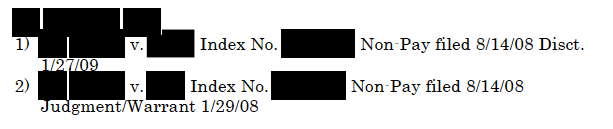

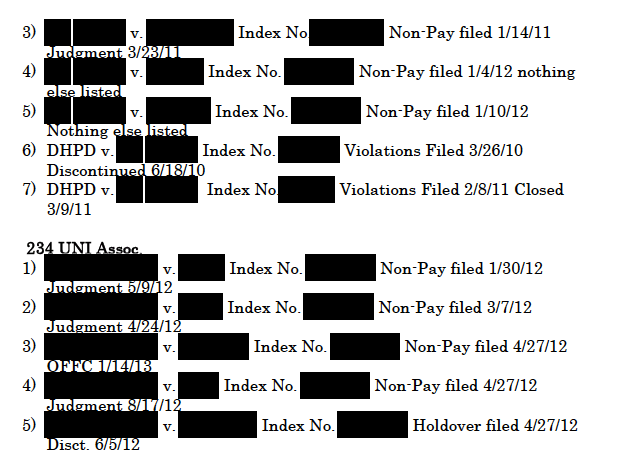

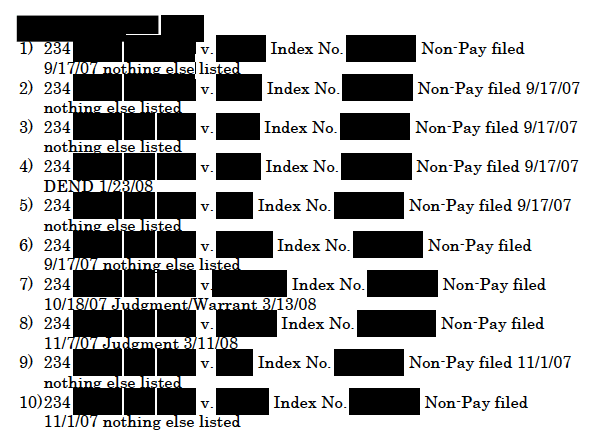

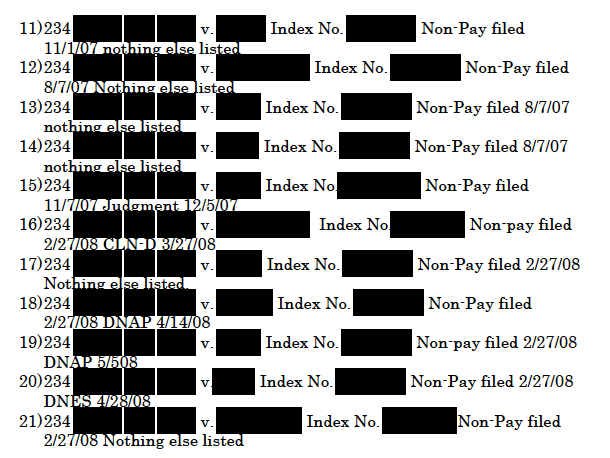

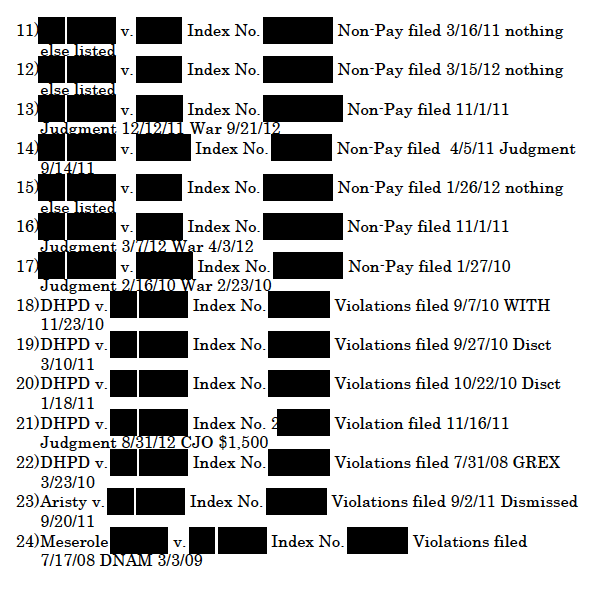

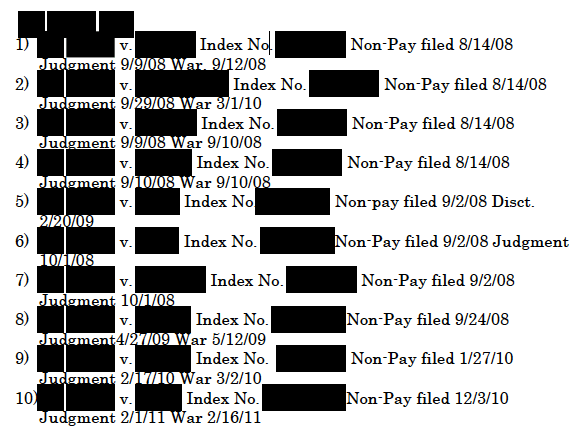

Court Investigations

Housing and Civil Court

The following is a list of the cases we obtained from the court’s computer database. The firm can obtain copies of any court file, at your request. By Friday, January 25, 2013, the firm will forward you copies of the 234 [redacted] Apt. 12 and [redacted] Apt. 21 holdover proceedings.

As you review the list of cases, you will find a number of nonpayment proceedings against the same tenant over the years. This data is useful in analyzing whether a tenant’s history of nonpayment is grounds for commencing a chronic nonpayment holdover proceeding. the firm can analyze any given tenant’s nonpayment history, at your request. That analysis requires pulling each court file to understand the allegations made by each side in the case and how the issues, if any, were resolved.

Please keep in mind that court files for cases in 2009 or earlier are in archives and at this time there is a backlog in filling requests for files from archives. Any requested archived files are expected to arrive no earlier than April 22, 2013.

Housing Cases

There were no cases against [redacted] & [redacted] as Respondents, found.

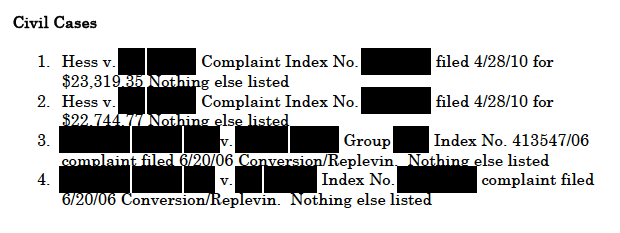

Supreme Court

There were no cases found where any of the ownership entities were named as defendants.

However, as previously reported, The firm ran judgment and lien searches by ownership entity names and by block and lot number. Annexed hereto as Exhibit “22” is a detailed listing of each of the hits the firm obtained in those searches.

From the detailed listing, you will notice that all but one of the HPD judgments are from 2008 or earlier. Annexed hereto as Exhibit “23” is a copy of the 2012 $1,500 judgment held by HPD against 234 [redacted]. That judgment appears to be for an unpaid fine assessed against [redacted] the owner prior to seller but entered against the building during the seller’s tenure.

The non-HPD judgments and liens appear to be minor but do require satisfactions of judgment to be filed. There is a 1991 and a 2003 NYC Bureau of Highway sidewalk lien filed against [redacted]. There is also a lien held by [redacted] against [redacted] a prior owner, and filed against both [redacted] and 234 [redacted].

The firm recommends that you ensure that satisfactions of judgment are filed for each and every judgment and lien prior to closing, should you choose to purchase the building.

As you know, customarily prior to closing a title search is run on the property which provides a more complete and up to date picture of the liens held against the property.

1 The Department of Finance tax information hotline: (212) [redacted]

2 Upon a showing of “fraud,” they are forever open to challenge. The case law has not been good about defining the boundaries of “fraud” when it comes to registrations, leaving judges very much to show their predilections when doing so.

3 The 2008 Registration report (page 30 of the DHCR Rent Roll) for [redacted] is missing.

4 Yes, we really do mean three. This has been checked and rechecked.

5 Theoretically, these scenarios could include having to demolish the upper half of the building. This office has had experience with such demolitions and the firm would be happy to provide you with an oral report as to what they entail, but such a narrative, being highly speculative at this point, is outside of the scope of this report.

6 The firm recommends you submit a FOIL request to obtain a copy of the DHCR Docket No. BL2302100M file to confirm which units were subject to the increase.

7 Experience teaches that anything that comes this close to the deregulation cut off numbers receives heightened scrutiny by tenants’ counsel, the courts, and the DHCR. The result of such scrutiny is often a finding that the premises are in fact-regulated because some of the costs are disallowed as “mere repairs” and the landlord is then hit with treble damages.

8 The less likely possibility is that it is an illegal apartment carved out of a legal one.

i Seller’s management provided unsigned contractor proposals, payment history spreadsheets and calculations showing how the unit was deregulated. They are annexed to the Due Diligence Report as Exhibit “7.” We recommend you obtain actual, cancelled checks and, if available, signed and/or “marked PAID” contractor proposals to verify the data provided on the spreadsheets.

ii Seller’s management provided unsigned contractor proposals, payment history spreadsheets and calculations showing how the unit was deregulated. They are annexed to the Due Diligence Report as Exhibit “8.” We recommend you obtain actual, cancelled checks and, if available, signed and/or “marked PAID” contractor proposals to verify the data provided on the spreadsheets.