Adam Leitman Bailey, P.C. Due Diligence Report 11

DUE DILIGENCE REPORT

Prepared By

Adam Leitman Bailey, P.C.

120 Broadway, Seventeenth Floor

New York, New York 10271

(212) 825 – 0365

alblaw.wpengine.com

May 30, 2014

Introduction

This report includes our due diligence research findings and analysis of the rent regulatory status of each of the residential units of Brooklyn, New York [redacted] (Kings County Block [redacted] Lot [redacted]). The building’s makeup called for particular attention to the rent increases applied by the owner over the years in order to forecast your potential overcharge exposure as a new owner of the building.

Early on in our investigations, we identified what we initially thought was “moderate” mismanagement but our assessment of that level escalated to “severe” after our due diligence analysis was completed. As you can easily see by a simple scan of the notes in the accompanying Tenant Worksheet, there is a dearth of renovation documentation to support the rent increases over the years. That lack of proof of renovation is more often than not for improvements that should have been performed in the 1990’s and 2000’s in order to properly support vacancy lease rents.

To properly assess the legality of an apartment’s current legal regulated rent, we review the history of rent increases dating back as far back as reliable data is available, which in this case is the 1987-1988. There is registered rental data for the years 1984 through 19871; however, we do not find that data wholly reliable because it was submitted to the Division of Housing and Community Renewal (“DHCR”) in 1988, as opposed to a contemporaneous submission. Furthermore, the Initial Registrations for the building, which were required to be submitted in 1984, were submitted in 1994, ten years after the fact. There is always some level of uncertainty attributed to due diligence analysis when an owner back-registers apartments, particularly when the calculations do not add up. In sum, our rent calculations are based on applying the allowable Rent Guidelines Board increase to the data published in the 1987 Registration and comparing that figure to the data published in the 1988 Registration. If our rent calculations did not match the registered legal rents, we continued calculations based on the rent figure least favorable to the owner in order to better capture the future owner’s worst case scenario overcharge exposure. Where proof of renovations is required to support a vacancy lease rent, we assume that proof is available in order to continue rent calculations to date.

Even a brief review of the notes in the accompanying Tenant Work Sheet reveals there is a remarkable shortage in proof of renovations. Upon your request, we can calculate your overcharge exposure for any apartment that lacks proof of renovation.

Our research also includes a review of the status of any open violations issued against the building by the Department of Housing Preservation and Development of the City of New York and the New York City Department of Buildings.

We also searched the files of the Supreme Court of the State of New York, New York County, the Civil Court of the City of New York and the Housing Court of the City of New York for pending litigation with respect to this building. Our court investigations also included a review of any judgments and liens held against the properties.

Our investigations produced the following results.

Overview of the Building

The building consists of 27 Class A residential units spread over 4 stories. On the second to fourth floors, the apartments are identified by floor number followed by letters, A through G. The first floor contains apartments identified by floor number “1” followed by letters, A through F. If you have not done so already, we recommend you walk through the building to determine why there is structurally no “G” apartment on the first floor. There is no Certificate of Occupancy for this building, thus indicating that the building was constructed prior to 1938 and there has been no change in use of the property nor have there been any additions to the building. If ever you need to know the legal use of the building, or any building in New York City, you can obtain a Letter of No Objection from the Department of Buildings’ borough office in Manhattan, or wherever the subject property is located. Upon request, we can obtain the Letter of No Objection for you. For your convenience, we provide below a link to details regarding obtaining a Letter of No Objection from the Department of Buildings.

Room Count Discrepancy

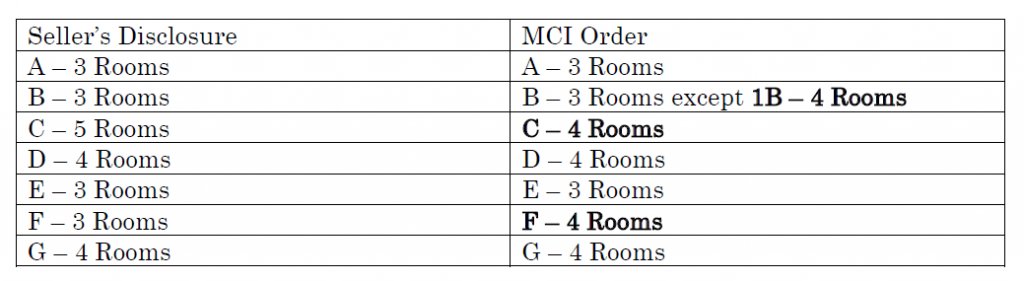

The room count provided does not match the room count established in the listing annexed to the May 21, 2010 MCI Order, a copy of which is provided in the Drop Box set up for this report. This discrepancy may explain the differentials we found in the application of the 2010 MCI and the current rents. We do not have a copy of the 2013 MCI Order because management misplaced it and our FOIL request to DHCR for a copy of the file is pending. However, the discrepancy in the current rents may be attributed to the application of the 2013 MCI and the discrepancy in the room counts.

On –Site Superintendent Requirement

There is no apartment in this building currently registered as employee or owner occupied, which raises a flag of illegality. The New York State Multiple Dwelling Law, Article 3, Section 83 provides apartment buildings that house thirteen or more families require the landlord to either:

a) Provide superintendent services himself, if he lives in the building;

b) Provide a superintendent who lives in the building, within 200 feet of the building or within one block of the building, whichever is greater; or

c) Provide for janitorial services to be available on a 24-hour basis.

In addition, the name of the building owner, or superintendent, or janitorial company (i.e. whoever provides janitorial services) must be posted in the lobby along with a telephone number for 24 hour contact.

The City of New York can issue a violation against the building if the owner is not in compliance with this rule. If you decide to purchase the building, you should verify that the owner is in compliance and require that the owner remain in compliance until closing. Failure to comply with this rule is expensive not merely for the fines that can arise, but for the necessity of removing some apartment from the income stream in order to come into compliance. Nothing in the law requires that the superintendent’s apartment be ground level, although this is the universal custom for a number of reasons.

Regulatory Status Analysis of Each Tenancy

Accompanying this cover report is our Due Diligence Tenant Worksheet that sets forth the name(s) of the current, record tenant(s), the lease terms, the rental rates, the unit’s regulatory status and notes with directives to you and/or the seller, based on our due diligence analysis. That analysis included, but is not limited to, a review of the leases and other documents obtained from the seller’s files, the Division of Housing and Community Renewal (“DHCR”) Registration Rent Roll and Case List, the seller’s management rent roll, and litigation files obtained through our court investigations.

The building is composed of one rent control apartment (1A), 25 confirmed, rent stabilized apartments, and one apartment (2C) that is purportedly exempt from regulation but also lacks proof of high rent vacancy deregulation.

Consequences of the Lack of Proof of Renovations

As previously mentioned, the accompanying Tenant Worksheet sets forth those apartments which lack the proper proof of renovations to support the current legal regulated rent. Our investigations revealed the following for various units:

- The dollar amount spent for renovations was not enough to increase the legal rents to the rate the owner ultimately charged to the vacancy lease tenant;

- The owner kept copies of checks to support renovations when only cancelled checks are an acceptable form of proof (see below for list of acceptable forms of proof);

- According to the New York City Department of Buildings’ Buildings Information System online, there are no DOB filings or permits issued to support any of the renovation work that was purportedly done at the building over the years2 ;

Generally speaking, rent increases may be challenged by a tenant up to four years after the installations and renovations. However, the January 8, 2014, amendments to the Rent Stabilization Code require owners and prospective owners, alike, to be especially mindful in preserving proof of renovations because in the event a tenant successfully establishes a claim of fraud, the DHCR reserves the right, and has always reserved the right, to demand further documentation from the owner to support its legal rent calculations. There is no limitations period for fraud claims. Obviously, the enactment of these amendments is relatively recent and the DHCR’s enforcement of these changes is yet to be seen in many ways. Therefore, if a tenant challenges the owner’s legal rent calculations, you will almost undoubtedly be required to provide the at least one of the following acceptable forms of proof, regardless of what year the renovations purportedly took place.

1. Cancelled check(s) contemporaneous with the completion of the work;

2. Invoice receipt marked paid in full contemporaneous with the completion of the work;

3. Signed contract agreement;

4. Contractor’s affidavit indicating that the installation was completed and paid in full.

However, these documents are generally lacking from the Seller’s files.

Lack of Preferential Rent Riders

Our calculations have shown that the owner leased apartments at a rate lower than the legal regulated rent after applying the applicable vacancy and individual apartment improvements increases. During “live” tenant file review, the managing agent represented that are no preferential rent riders for any of the tenancies, past or present. The owner’s failure to preserve its right to collect the higher rent is a permanent loss of the opportunity to deregulate the apartments sooner.

J-51 Tax Abatement (1998 Pointing and Roof Work)

On May 29, 2014, the seller provided a Certificate of Eligibility for a 14 year tax abatement under the New York City Department of Housing Preservation and Development J-51 Tax Benefit Program. The tax benefits were conferred based on a pointing and roof surface project slated to start on December 11, 1998.

If an owner is receiving J-51 tax benefits, all units in the building become subject to rent stabilization until vacancy after the benefits are no longer received or if the required rider notifying the tenant of the building’s participation in the program is included with the original lease and every renewal thereafter, then at the time of the expiration of the tax benefit period.

The Certificate of Eligibility was issued on April 30, 2003 but does not clearly state when the 14 year tax abatement period begins and ends. We verified that the building is not receiving benefits at this time. We recommend you ask the seller when the abatement period expired and confirm whether the required rider was attached to the leases and renewal leases executed during the tax benefit period. Our review of the paperwork that the Seller does maintain leaves us less than optimistic that this paperwork would exist.

Permanent Rent Increases Authorized by DHCR MCI Orders

According to the DHCR Case List, DHCR granted four Major Capital Improvement (“MCI”) applications on the following dates, November 29, 2013, May 21, 2010, February 13, 1989 and January 16, 1985. During live tenant file review, the seller provided a copy of the 2010 MCI Order which we analyzed and report on in the accompanying Tenant Worksheet. According to management’s email received on May 29, 2014, they lost a copy of the 2013 MCI Order. Simultaneous with issuance of this report, we will submit a FOIL Request to obtain a copy of the 2013 MCI Order. Upon request, we can submit a FOIL Request for the 1988 and 1989 orders and note that the DHCR has designated those files as “CLOSED/HISTORICAL” and may not be easily obtained.

For the most part, the seller correctly applied the increases authorized by the 2010 MCI Order but as previously advised, there is a discrepancy in the room counts as disclosed by the seller versus the room counts set forth in the 2010 MCI Order which may explain the discrepancies we found and report on in the Tenant Worksheet.

If you decide to pursue the purchase of this building, we recommend that the purchase contract forbid the seller from issuing lease renewals until the discrepancies in the current rental rates are resolved.

MBRs

The seller concedes that Apartment 1A is rent control. Therefore, we examined the MBR Orders and documentation provided by the seller, copies of which are included in the Drop Box set up for this report in the “Tenant Files” Drop Box folder. While the preferred method of confirming the rent was legally increased over the years is to review each MBR order issued in favor of the building and run the appropriate calculations, there was only one occasion that the tenant of 1A applied for an “administrative review” and that one application was rejected by the DHCR on October 16, 1991. Therefore, it is not the best use of resources to run 40 years of MBR calculations. Upon request, we can submit a FOIL request for copies of all the MBR orders granting rent control rent increases and run those calculations.

The MBR Order issued on February 2, 2012, increased Apartment 1A’s 2013 Adjusted Maximum Base Rent to [redacted] (current rent is [redacted]) and the owner filed the corresponding Maximum Base Rent Building Schedule. Copies of the Order and the Schedule are provided in the Drop Box set up for this report.

There is an open MBR Application pending before the DHCR under Docket

No. [redacted].

Fuel Cost Adjustments

The seller provided Fuel Cost Adjustment Reports and Certifications for the

years 1993, 2012 and 2013. No increases were granted in those years.

New York City Violations Issued Against the Building

NYC Department of Buildings (DOB)

The Department of Buildings classifies this building as “C1-Walk Up Apartment”. This is a Department of Finance classification used to classify the premises’ tax status, as distinct from its legal use which is typically set forth in the Certificate of Occupancy. As noted above, there is no Certificate of Occupancy for this building on file with the DOB. A walk-thru and inspection of the building is necessary to verify the use of the building and confirm exactly how many residential there are in the building.

There is 1 open DOB violation. You can view the open violation online using the New York City Department of Buildings’ Buildings Information System located at [redacted]. You can easily access that site by conducting a Google search on “Building Information System.” The open violation is a boiler violation issued on January 1, 2009 which we suspect gave rise to the sewer, heat control and fuel burner work that resulted in the 2010 MCI Rent Increase. You should confirm that the MCI work is related to this DOB violation and require the owner to certify and pay any imposed fines prior to closing or alternatively, ensure you receive a credit for the cost of formally disposing of the open violation.

Department of Housing Preservation and Development of the City of New York (“HPD”)

A copy of the HPD Building Registration Summary Report and Open Violations Report as of May 30, 2014 is provided in the Drop Box set up for this report. There are currently 79 violations considered “open” by HPD. Those violations consist of 18 Class “A” violations, 42 Class “B” violations and 19 Class “C” violations. The majority of the open violations to Apartments 2B and 2C. A copy of the open violations report as of May 30, 2014,

Thirty of the open violations were issued in 2011 in Apartment 2C which supposedly underwent renovations in 2013 though the seller could only provide proof installation of new appliances. Nine of the Class “C” violations are lead paint violations. If indeed the apartment was renovated, then presumably lead paint remediation and other construction was performed to resolve most if not all of the Apartment 2C violations.

The more recent tenant culprit is long-time rent stabilized tenant, [redacted]. In 2013 and 2014, [redacted] apartment, 2B, incurred 14 HPD violations, two of which are Class “C” violations.

We suggest you negotiate a credit for each of the open HPD violations or have them resolved by the closing date and demand proof of payment for all associated administrative fees, if any. When you conduct the pre-closing walk-thru of the building, you should confirm that each violation has been corrected and photograph each repair.

Property Shark Report

The Property Shark Report for the building, which includes information pertaining to the neighborhood, ownership, property tax assessment, zoning and size, is provided in the Drop Box set up for this report.

Court Investigations

Housing and Civil Court Cases

Housing Court

A complete list of all the cases brought by and against the current and predecessor owners of the building is available for your review in the Court Investigations Case List folders of the Drop Box set up for this report. If you would like us to retrieve and copy any court files that are not provided with this report, please let us know. Any court cases dated 2010 and earlier are currently in court archives and can take up to fourteen weeks for the court to retrieve them.

[Redacted] (Apartment [redacted])

There was only one available court file that we find valuable for the purposes of this report. That file is for a 2011 nonpayment proceeding against [redacted], the rent stabilized tenant in Apartment [redacted] has been a respondent in seven nonpayment proceedings during her eleven year tenancy. Each of those proceedings was settled by a Stipulation of Settlement which presumably sets forth a payment plan for her to catch up on the rent with a stay of execution of warrant of eviction should she default. Obviously she was able to make the payments as she currently remains in occupancy. If you purchase the building, we recommend you flag her tenancy for chronic nonpayment which is grounds for terminating her tenancy and perhaps ultimately evicting her. We requested a copy of the 2011 nonpayment case which we should receive early next week at which time we will supplement this report.

We highlight notable litigation relating to each apartment in the accompanying Tenant Worksheet.

Civil Court

In 2002, the seller sued the former tenant of Apartment 2G, “[redacted]” for conversion (illegal taking, deprivation of property) but [redacted] never appeared. There are no judgments, final orders or decisions listed on the court computer. Upon request, we can request the file and review it for you.

In 2001, [redacted] sued the seller for replevin (recovery of personal property). The seller never appeared in the case. There are no judgments, final orders or decisions listed on the court computer. Upon request, we can request the file and review it for you.

In 1999, one “[redacted]” sued former owner, [redacted], for conversion. [Redacted] never appeared. There are no judgments, final orders or decisions listed on the court computer. Upon request, we can request the file and review it for you.

The three cases described above should have no bearing on your decision to purchase the building since there was little to no court activity and the cases are essentially (though not formally) abandoned at this point in time.

Supreme Court

There are no Supreme Court actions against the current or predecessor owners.

We also ran judgment and lien search by block and lot number. We obtained one hit for a sidewalk lien docketed on January 5, 2000, and held by the New York City Bureau of Highway Operations which is likely to be for sidewalk repair work that the City undertook since the owner did not do so. The court detail report which is provided in the Drop Box set up for this report in the folder titled “Court Investigations” indicates that the lien was “cancelled” on June 17, 2003.

If you wish, we can perform a deeper search of the court’s files if you want us to confirm just exactly how these liens came to be placed on the building.

We recommend you ensure that satisfactions of judgment are filed for each and every judgment and lien prior to closing, should you choose to purchase the building.

As you know, customarily prior to closing a title search is run on the property which provides a more complete and up to date picture of the liens held against the property.

CONCLUSION

This building shows considerable signs of poor management. The lack of paperwork to support the claimed individual apartment improvements presents a major hazard to a potential purchaser. While these undocumented improvements were problematic at the time they were first claimed, over the course of the past two years they have become vastly more hazardous for anyone who owns the building. The DHCR formed the Tenant Protection Unit (TPU) for the very purpose of investigating patterns of fraud such as those that appear to be present in this building. There can be little doubt that at some point the TPU will get around to investigating this building and when it does, the overcharge assessments could be staggering.

Worse than that, however, where there is a pattern of mismanagement like that we have uncovered in this investigation, it frequently points to equally bad management of the physical aspects of the building as well. That problem with such mismanagement of the physical plant is that the building can and often does contain latent defects in building systems that are not readily apparent upon an ordinary engineering examination. Such problems, perhaps known to the seller, can be another trap waiting to spring on any purchaser.

In short, this is a very high risk building.