Adam Leitman Bailey Due Diligence Report 3

DUE DILIGENCE REPORT

PREPARED BY

ADAM LEITMAN BAILEY, P.C.

120 BROADWAY, SEVENTEENTH FLOOR

NEW YORK, NEW YORK 10271

(212) 825-0365

alblaw.wpengine.com

April 12, 2013

DUE DILIGENCE REPORT

PRELIMINARY STATEMENT

A preliminary review of the building’s documentation showed a building not of the usual kind our firm has come to expect of your firm – buildings that can benefit greatly from the kind of management your firm brings to a building, raising it from eyesore to valuable commodity. This alerted us that there had to be some theme the documentation did not reveal. In inquiries we had with your office and our inquiries with the current management, we developed an understanding of the building beyond the paper level. That beyond-paper understanding gave us a perspective on the paper reflected in this report. In short, the building is largely a paper fiction. Facts and figures on the paper are, to a large extent, fictional constructs of the current management based on a management style relying heavily on the transient population of the building, [redacted] students, who come and go after a couple of years with other agendas than holding the management to account for the violations of the regulatory laws. Skillfully transitioning the building out of this reliance on silence can make the building both fully legalized and highly profitable, with relatively low risks of prior mismanagement coming back to haunt new management as statutes of limitations expire. But, it must be recognized that mistakes in such transitioning can blow things up.

Although sometimes difficult to accomplish, particularly on the architectural level, ownership’s acquisition of two or more adjacent vacant apartments reconfigured so as to make each of the apartments have a changed overall footprint and square footage would have the effect of making all such apartments sources of zero liability once the appropriate statutes of limitations had passed.

INTRODUCTION

This report includes our due diligence research findings and analysis of the rent regulatory status of each of the residential units of [redacted].

Our due diligence investigation includes a calculation of the legal regulated rents for each of the apartments based on certain, enumerated assumptions made and founded on relevant Rent Guideline Board Orders and/or Rent Stabilization laws. Our investigation also includes, where applicable, an analysis of the regulatory status of each apartment and how each free market apartment was deregulated.

Our research also includes a review of the status of any open violations issued against the building by the Department of Housing Preservation and Development of the City of New York and the New York City Department of Buildings.

We also searched the files of the Supreme Court of the State of New York, New York County, the Civil Court of the City of New York and the Housing Court of the City of New York for pending litigation with respect to this building. Our court investigations also included a review of any judgments held against the property.

Our investigations produced the following preliminary results.

Overview of the Building

The building consists of 22 Class A residential units spread over six stories. The actual use of the residential units appears to be consistent with the Certificate of Occupancy for the building. A copy of the Certificate of Occupancy was previously provided by the seller. According to the Certificate of Occupancy, the building consists of six stories with stores and apartments on the first floor and apartments on the second, third, fourth, fifth and sixth floors. The apartment designations (i.e. 21, 22, 23 and 24) indicate that there are four residential units on each of the upper floors leaving two residential apartments on the first floor. One of the stores on the ground level is a pornography shop. The presence of such businesses tends, generally speaking, to depress the market value of free market apartments.

EXPOSURE TO OVERCHARGE LIABILITY

As you know, our gravest concern regarding this building is the unknown. By that, we refer to the following:

- The current, undocumented tenancies;

- The fact that the tenancies registered with DHCR since 2006 are fictitious and unsubstantiated by leases;

- The fact that the dates most of the current occupants moved in is unknown and therefore, the dates their “terms” expire is arbitrary.

These factors collectively expose you, as a potential owner, to overcharge liability. In order to narrow down your liability, we calculated the current legal regulated rents based on the full history of DHCR registration leading up to 2005, that is, the last year, for the most part, we have documented tenancies. That calculation is also based on the allowable vacancy lease increases and most importantly, on certain assumptions we were forced to make in order to bridge the gap between the “unknown” and reaching that “hard” legal regulated rent calculation necessary to capture your potential overcharge liability. Certainly, since they are based on assumptions, albeit mindful assumptions, these calculations should be used solely for the purpose of capturing a picture of liability, and forming a defense, should a tenant question an apartment’s regulatory status and legal regulated rent.

THE FICTITIOUS DHCR REGISTRATIONS

Each of the registrations submitted to DHCR in the years after the last documented tenancy, which in most cases is for the term 2005 to 2006, are fictitious and were submitted by the seller to satisfy its perception that registering some data, even fictitious data, is beneficial somehow. Interestingly, that may be true, to an extent. A page by page, quick review of the DHCR Rent Roll for the years following 2005/2006 does not raise any red flags. It appears, on first glance, that the rents have been properly increased through the years.

If you decide to purchase the building, you will need to decide whether to “let a sleeping dog lie” and leave those fictitious registrations undisturbed since any amendment to the registrations resurrects the four year look back period. However, you must keep in mind that there is no statute of limitations on claims of fraudulent registrations. Thus, the more quickly apartments move to free market status, for whatever reason, the better. While this might appear a truism of housing in Manhattan generally, it is particularly true of this building.

We have previously advised to ensure the contract of sale forbids the seller from registering the building with DHCR in 2013. If you purchase the building, you will need to do so. Obviously, for those apartments you receive vacant, the registration must reflect permanent exemption by high rent vacancy deregulation. Apartments [redacted] and [redacted] were erroneously treated as deregulated over the years and need to be registered to reflect its rent stabilized status and its associated legal regulated rent. On the other hand, Apartment [redacted] was previously treated as rent stabilized and theoretically deregulated in 2007 upon the departure of [redacted] keeping in mind we do not know when he actually vacated as the DHCR Rent Roll still identifies him as the record tenant of the apartment).

The apartments that remain tenanted at closing must be registered with DHCR, although continuing fictitious registrations is obviously not advisable and not only inconsistent with your firm’s management style, but perhaps more importantly, your firm’s reputed management style. The downside to legitimizing the tenancies by properly registering them is that the legal regulated rents in many cases decreases if you use our calculations that are based on the 2005 to 2006 last documented tenancies. The overcharge exposure spreadsheet provided herewith shows our calculation of the legal regulated rents for each rent stabilized apartment which can be compared to those in the DHCR Rent Roll to identify which apartments would suffer that decrease.

Upon our calculation of the legal regulated rents, there are 12 rent stabilized apartments, 4 rent controlled apartments, 4 deregulated apartments and 2 potentially deregulated, if not, rent stabilized apartments.

We understand that there may be one rent control apartment that is currently vacant, though the seller has not identified which apartment it is. When and if you get back that apartment, you will need to file a vacancy decontrol report with the DHCR and presumably, if the vacancy increase and apartment renovations meet the $2,500 threshold for deregulating the apartment, then you must register the apartment as permanently exempt, high rent vacancy deregulation.

DHCR CASE HISTORY

The DHCR Case History did not reveal anything alarming. The only notable case is discussed in the accompanying overcharge exposure spreadsheet. The 1994 tenant of Apartment [redacted] filed a fair market rent appeal application with DHCR who ultimately denied it.

NYC Department of Buildings (DOB)

The Department of Buildings classifies this building as “C7-Walk Up Apartment”. This is a Department of Finance classification used to classify the premises’ tax status, as distinct from its legal use which is typically set forth in the Certificate of Occupancy. As noted above, the use of the building appears to be consistent with the use defined in the Certificate of Occupancy. A walk-thru and inspection of the building is necessary to verify the use of the building and confirm exactly how many residential and commercial units there are in the building.

There are 11 open DOB violations. You can view the 11 open violations online using the New York City Department of Buildings’ Buildings Information System located at http://a810-bisweb.nyc.gov/bisweb/bsqpm01.jsp. You can easily access that site by conducting a Google search on “Building Information System.” The 11 open violations are composed of a mixture of construction, boiler, landmark and zoning violations. The contract of sale should require the seller correct, certify and pay any imposed fines prior to closing or alternatively, ensure you a credit for the cost of correcting violations that are open on the date of closing.

There are 4 open Environmental Control Board violations as of the date of this report. You can view these violations online on the Department of Building’s Building Information System as well.

There is a 2005 violation for illegal use of the commercial space located on the east side of the first floor. As you know, the commercial tenant has been and continues to operate an adult novelty and pornography business. This illegal use may be grounds for evicting the tenant, particularly if you look to the Rider and Renewal Agreement dated June 15, 2011. See Paragraphs 13 and 16 of same. The seller has provided two similar, executed Riders but only the June 15th, 2011 Rider contains the provisions that place liability on the tenant for this illegal use.

Similarly, there is a 2004 violation for an illegal fire escape drop ladder on the first floor. It is unclear from the violation exactly where the illegal drop ladder is located but we understand that it is in one of the commercial spaces both of which are leased entirely by the adult novelty and pornography store. The June 15, 2011, Rider provides at Paragraph 13 that the tenant is responsible for curing all City violations imposed on the premises. As such, this presents another opportunity of grounds to evict the tenant, which, from a business point of view, may make sense to you, as a prospective purchaser. As previously mentioned, the presence of an adult novelty and pornography store drives down the value of the free market residential units.

There is a 2009 violation for loose masonry at the western parapet wall. You may wish to have a professional engineer evaluate the building for structural and safety issues and assess the cost to correct and certify correct this violation with the Department of Buildings.

The fourth and final violation appears to be a zoning violation for failing “to comply” with a variance or special permit issued by the New York City Board of Standards and Appeals, the agency group that gives landowners “relief” from the zoning code. That permit has expired and has not been renewed thereby requiring the seller to comply with the applicable, original zoning regulation. The Buildings Information System does not give us access to zoning related permits therefore a further in-person investigation is required in order to learn exactly what the nature of the expired permit and this 1998 violation is. We do know that the violation remains open today.

The contract of sale should require the seller to correct, certify correct and pay any fines imposed as a result of these violations or alternatively, ensure you receive a credit for each open violation at closing, if they are not certified as corrected and dismissed before closing. We calculate the Environmental Control Board violations to amount to $1,610 in fines.

If you purchase the building, your pre-closing walk thru should include verification that all of the violations have been corrected and/or credited at the closing table. It is highly unlikely that the pornography situation will have been corrected by that point and it will be advisable to set up an escrow fund for the purpose.

The Department of Housing Preservation and Development

of the City of New York (“HPD”)

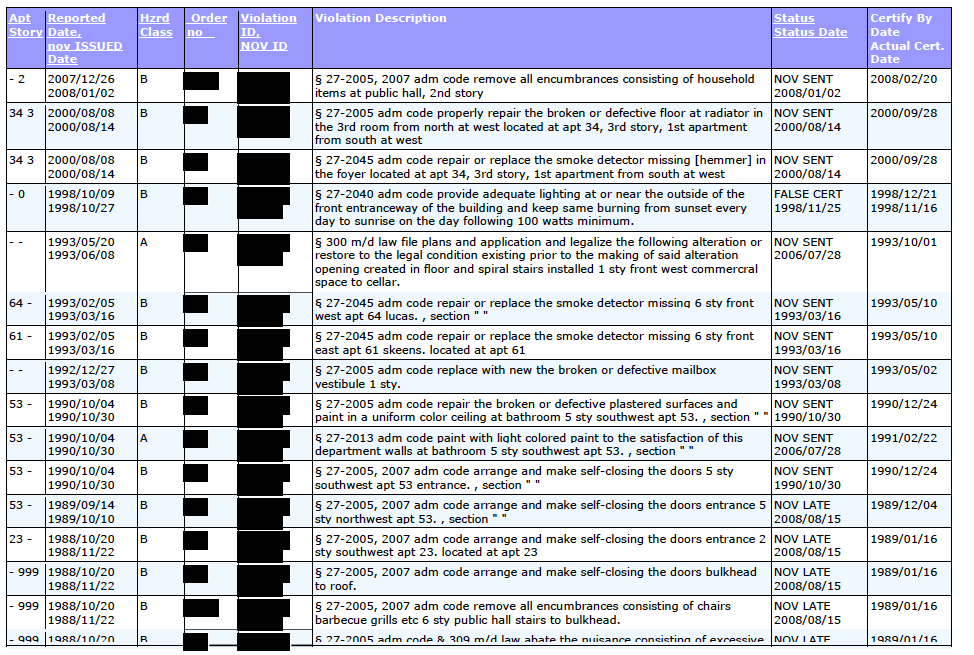

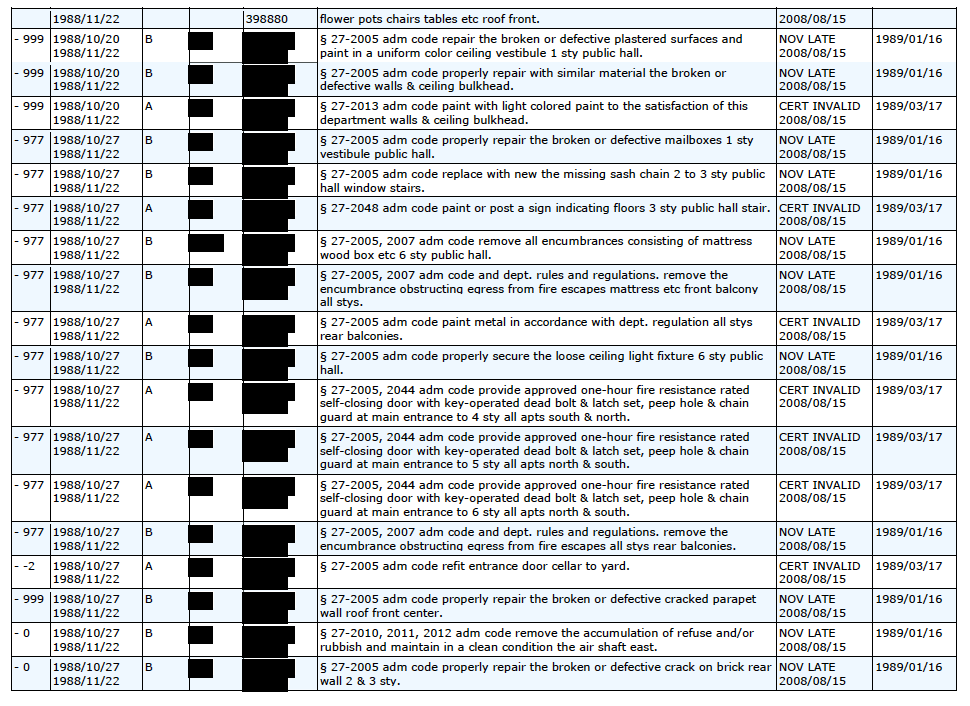

There are 9 Class A violations, 25 Class B violations and no Class C violations that the HPD considers open at the building as of the date of this report. Those violations are copied below:

Open Violations – ALL DATES There are 34 Violations. Arranged by category: A class: 9 B class: 25 C class: 0 I class: 0

For Definitions of the columns indicated below, select glossary under the Services option (located at the upper right). To sort the columns, click on their underlined headers below in the blue area.

The building’s current violation history is indicative of a building that is relatively well maintained and/or composed of tenants who turn to the landlord for maintenance issues as opposed to calling the City causing an HPD inspector to issue a violation. Similarly, as discussed in the Court Investigations section below, the current and recent tenants have had no reason to sue their landlord at Housing Court for failing to properly maintain the building. These findings are consistent with the transient nature of the building’s tenancies and your suspicion that the building is largely composed of students lacking visas to support their presence in this country. Indeed, most of these recorded violations are trivial and with a couple of weeks of diligent work could be removed. Thus, they are part of the overall pattern of a building that on paper, looks pretty good.

You may want to get a credit for each of these open violations or have them resolved by the closing date and demand proof of payment for all associated administrative fees, if any. When you conduct the pre-closing walk-thru of the building, you should confirm that each violation has been corrected and photograph each repair.

Property Shark Report

We have included a copy of the Property Shark Reports on the building which includes information pertaining to the neighborhood, ownership, property tax assessment, zoning and size.

A copy of the report will be sent to you in a separate email.

Court Investigations

Housing and Civil Court

A list of cases pulled up from the Court’s computer database is provided herewith indicating the title of the proceeding, index number, date the action was filed, the type of proceeding and the last activity noted on the Court’s database. As previously mentioned, the seller has never been sued by the tenants in an HP proceeding which are usually limited to violations placed by DHPD.

Files for cases containing an index number of 2009 or earlier are maintained in the Court’s archives and currently can take up to 12 weeks to retrieve from storage. There are no cases that we feel should be requisitioned from archives at this time. However, if there is a certain file you wish to see, we can submit a request on your behalf.

Supreme Court

The case list provided includes our research findings at the Supreme Court of the State of New York, New York County. As you know, there was a negligence, slip and fall action brought against current tenant, [redacted] of Apartment [redacted] which was settled early this year for $260,000 in favor of the tenant. Enclosed is a copy of the court file which contains a motion to settle the money judgment that sets forth the amount of the settlement. In addition, the seller has provided copies of the Stipulation of Discontinuance and the General Release signed by [redacted] when he received the $260,000 payment from the seller’s insurance company. Interestingly, that General Release contains language that the tenant releases the seller and its “successors” from all claims. However, there is no guarantee that a judge of the Supreme Court or administrative judge of the DHCR will find that the General Release applies to a release of an overcharge claim, and certainly not if the overcharge was committed after that Release was executed.

The only other Supreme Court litigation against the seller is [redacted] v. [redacted] a 1990 case that was never pursued. Curiously, there was a 1992 case with the same parties, identified in the court’s database as a “Conversion” case, that was apparently disposed of in 2008. The case file is in archives and can be obtained upon request.

We also ran a judgment and lien search by block and lot number on the property. There was one 1987 sidewalk lien retrieved for $0.00. A sidewalk lien is placed on the property by the Department of Transportation who had to undertake a sidewalk repair at the premises. A satisfaction of lien should be filed in order to properly paper the lien as closed.

As you know, customarily prior to closing a title search is run on the property which provides a more complete and up to date picture of the liens held against the property.

CONCLUSION

There can be little doubt that this is a building that can benefit from your firm’s business model of taking ill managed low profit buildings and converting them to higher profitability. Because of the massive cognitive disconnect between the paper reality and the true reality of this building, it is going to require even more finesse than most of the buildings we have seen undergo this process.